Learning from Ireland: The Case for Bold Corporate Tax Reform in Canada

July 11, 2025

Canada is facing mounting economic challenges: business investment is stagnating, productivity growth remains sluggish, and living standards have barely budged in years. With global trade uncertainty on the rise and the U.S. changing its business tax regime, Canada’s own corporate tax system is due for a serious rethink. Prime Minister Mark Carney’s campaign pledge to review it couldn’t be more timely.

To envision what’s possible, Canada could look across the Atlantic to Ireland. Just three decades ago, Ireland was one of Europe’s economic underperformers. Today, its living standards have not only caught up to Canada’s, they’ve surpassed them by a wide margin. At the core of this transformation is a bold approach to corporate tax policy, and this turnaround could offer valuable lessons for Canada as it considers reforming its own corporate taxes and building a more competitive and prosperous economy.

The Case for Reforming Canada's Corporate Tax System

Canada has been down the road of corporate tax reform before. In the late 1990s, economist Jack Mintz led a major review that sparked bipartisan action to improve the country’s tax competitiveness. Both Liberal and Conservative governments federally, along with many provinces, took action to reduce the combined statutory corporate tax rate from over 42% to today’s average of approximately 26%.

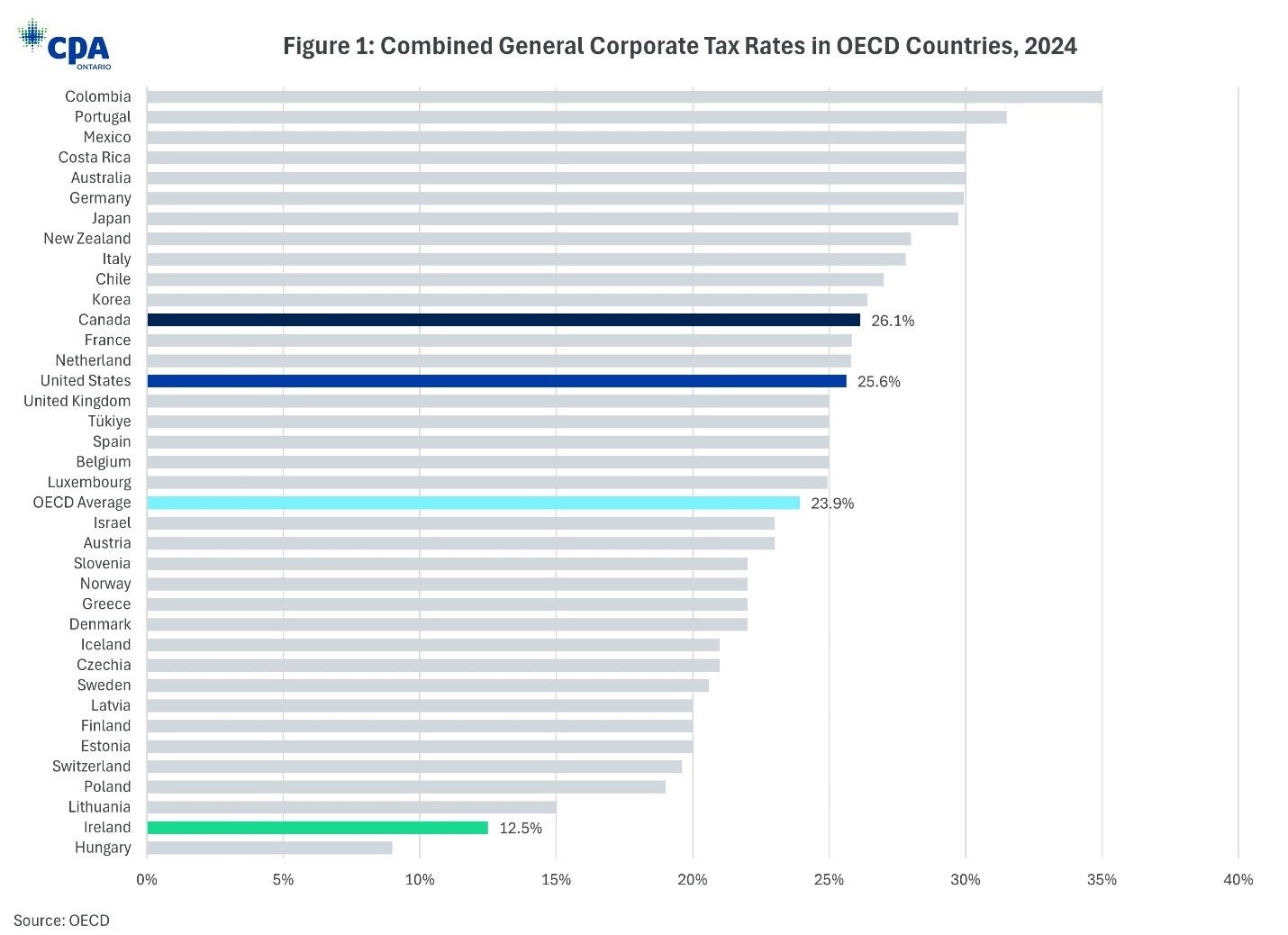

There was broad agreement across party lines that lowering corporate taxes would benefit Canadians by encouraging greater investment. The reforms made Canada more competitive at the time, but the world hasn’t stood still. Canada’s combined rate now exceeds the OECD average (see Figure 1), making Canada less attractive for mobile investment.

Learning from the Celtic Tiger: Ireland's Competitive Corporate Tax

Ireland offers a compelling case study in the power of corporate tax policy, including an unwavering commitment to a low headline rate. Between 1997 and 2003, Ireland reduced its corporate tax rate from 36% to 12.5%; less than half of Canada’s current average combined rate of 26.1%.

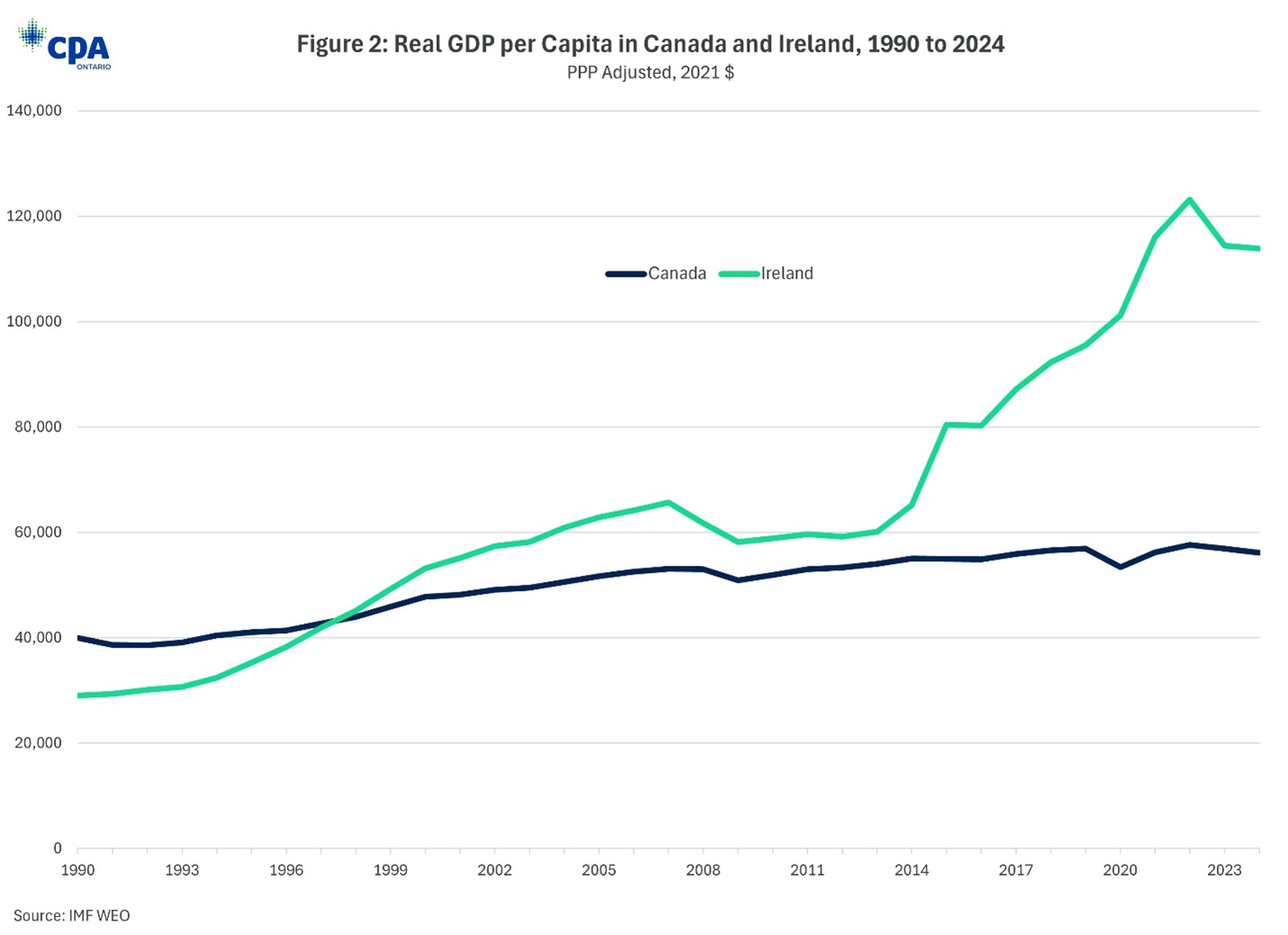

Once one of Western Europe’s poorest countries, the so-called “Celtic Tiger” underwent a dramatic transformation, emerging as one of the region’s richest on a per capita basis. In the early 1990s, Canada’s real GDP per capita was significantly higher than Ireland’s. By the late 1990s, Ireland had overtaken Canada, and today, Irish GDP per capita is roughly double that of Canada’s (see Figure 2).

It’s important to acknowledge that Ireland’s economic statistics have faced scrutiny. Economist Paul Krugman famously coined the term “leprechaun economics” after a reported 26.3% surge in Irish GDP in 2015 (later revised even higher) largely attributed to multinational corporations shifting intellectual property and profits through Ireland for tax purposes. Critics argue that such figures overstate the genuine economic gains experienced by ordinary Irish citizens.

Still, the broader economic transformation in Ireland is difficult to dismiss. According to Irish government estimates, the reduction of the corporate tax rate to 12.5% increased the country’s gross national product by 3.7%. While a low corporate tax rate was central to Ireland’s strategy, a key insight is the philosophy behind it. As a 2020 Canadian Tax Foundation analysis noted, Ireland prioritized simplicity and competitiveness in the corporate tax system, favouring low rates over complex tax credits or targeted subsidies. This approach positioned the country as a preferred destination for multinational investment, successfully attracting high-value sectors such as technology, pharmaceuticals, and financial services, along with the jobs and capital they bring.

Research published in the Journal of Monetary Economics found that substantial reductions in the corporate tax, combined with openness to international capital, were associated with large increases in foreign direct investment and economic output. Tax reform alone did not account for the full extent of Ireland’s economic transformation; it played a powerful reinforcing role alongside other structural changes. Ireland became a major base for U.S. multinationals, drawing in not only capital but also high-paying jobs, robust supply chain linkages, and productivity-enhancing spillovers.

Ireland also capped its top marginal tax rate for individuals at 40% and employed policy tools like a patent box regime, offering preferential corporate tax treatment for income derived from qualifying intellectual property developed within the country, to spur innovation within Ireland. The key lesson from Ireland is that clear rules, competitive rates, and a commitment to simplicity can create a pro-growth environment.

Subscribe to the CPA Ontario Insights Newsletter

Public policy and thought leadership for CPAsSign up on LinkedInImplications for Canada's Economic Future

Various technical aspects of Canada’s corporate tax system warrant attention, but significant reductions in the rate could stimulate investment, enhance productivity, drive economic growth, and ultimately boost wages. A bold corporate tax change could serve as a signature policy move, providing the kind of stimulus the Canadian economy urgently needs.

Rate cuts are just one path; Canada could also look to other innovative approaches to stand out globally. For instance, Estonia's unique corporate tax model only taxes profits when they are distributed to shareholders. This "distributed profits" model effectively defers tax on reinvested earnings, providing a strong incentive for businesses to retain and reinvest their profits within the company, fostering growth and job creation. Other areas of the corporate tax system, such as the immediate expensing of investment and small business taxation, also warrant a fresh look to ensure they are encouraging innovation and growth.

Conclusion

Corporate tax reform is a powerful policy lever—not a cure-all for Canada’s economic challenges. A meaningful and sustained boost will require a broader strategy that reforms personal taxes, cuts red tape, strengthens competition, fuels innovation, and invests in infrastructure, among other things.

Recent U.S. tax policy developments are intensifying the pressure on Canada to improve its own investment climate. President Trump’s One Big Beautiful Bill Act (OBBBA), passed on July 4, 2025, extends key provisions of the 2017 Tax Cuts and Jobs Act and introduces new measures to boost investment, including permanent full expensing for short-lived assets and domestic R&D. The administration also struck a deal with the G7 last month to exempt U.S. multinationals from the OECD’s 15% global minimum tax (Pillar 2), potentially giving them a further tax advantage. While not included in the OBBBA, Trump’s campaign pledge to lower the federal corporate tax rate to 15% would make the U.S. more attractive for investment vis-à-vis Canada.

Prime Minister Mark Carney’s pledge to launch “an expert review of the corporate tax system based on the principles of fairness, transparency, simplicity, sustainability, and competitiveness” signals that change may be on the horizon. Ireland’s success shows that coherent tax policy, anchored in low rates, clear rules, and a commitment to competitiveness, can drive long-term growth. Canada has a timely opportunity to act boldly and design a modern corporate tax system that supports investment, innovation, and rising living standards.